Purpose of the Tool

This web‑based application offers an interactive, step‑by‑step walkthrough of a Credit Default Swap (CDS) trade from deal negotiation to final termination.

It is designed for:

Students & trainees exploring credit derivatives for the first time.

Risk, middle‑office and operations teams who need to visualise the post‑trade workflow.

Link to the tool: https://cdstradelifecycleguide.foreranger.com/

Quick‑Start Checklist

Open the page. The application loads in your browser with no installs required.

Verify your screen is at least 768 px wide for the best split‑panel layout.

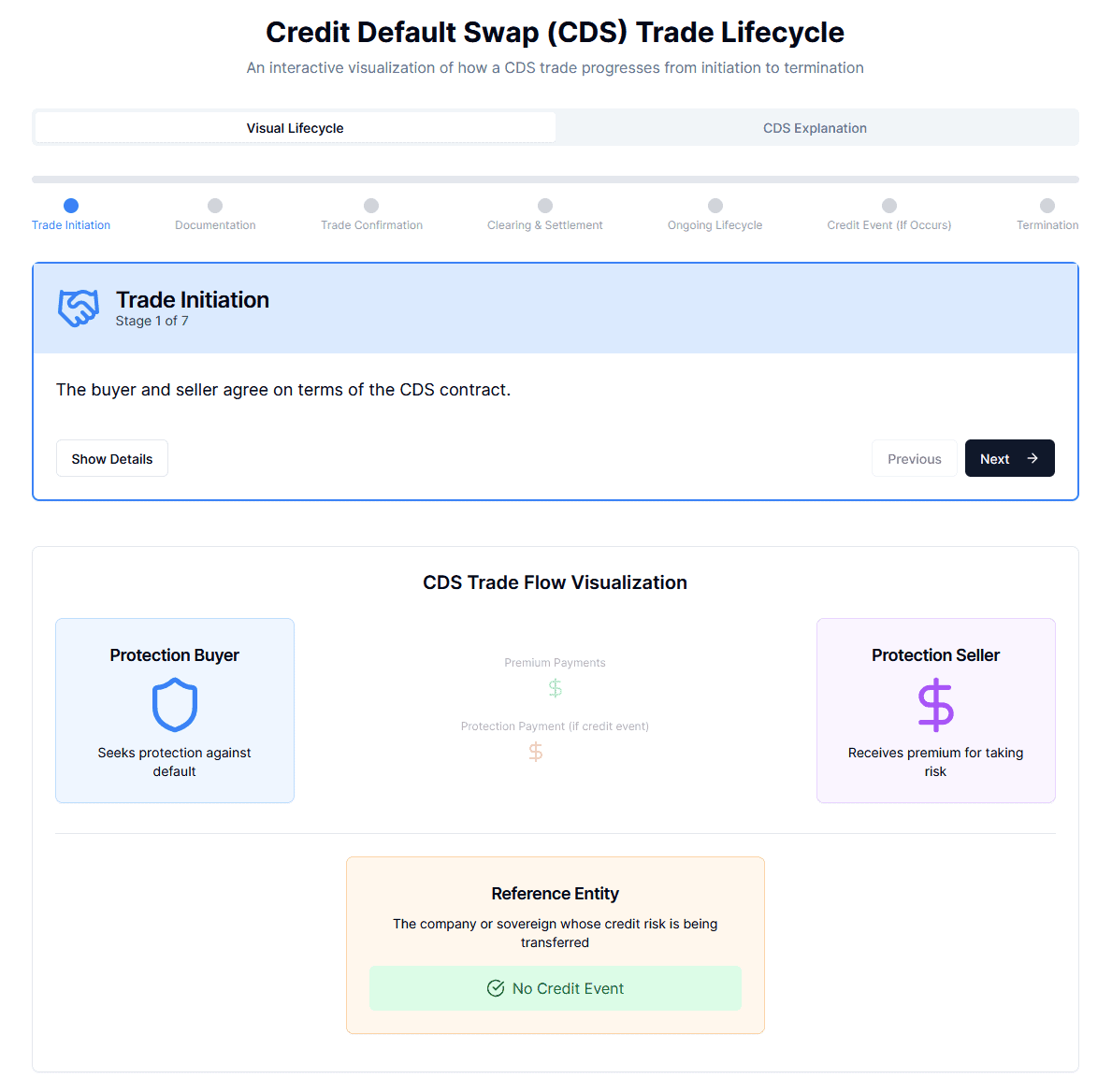

The default view is the Visual Lifecycle tab – you should see a progress bar and the first stage card, “Trade Initiation”.

Tip: The app supports light & dark mode automatically. Use your OS theme toggle or the ☾/☼ button if provided by the host site.

Navigating the Interface

| Element | Where to find it | How to use |

|---|---|---|

| Tabs (“Visual Lifecycle” / “CDS Explanation”) | Top of the viewport | Click to switch between the animated workflow and the background reading panel. |

| Stage Tracker | Horizontal line under the heading | Click any dot or stage title to jump directly to that step. A blue fill shows percentage completed. |

| Stage Card | Centre of the page | Displays the current stage title, icon, short description and Show Details toggle. |

| Prev / Next buttons | Bottom‑right of the card | Walk the lifecycle sequentially. Shortcuts: ← / → arrow keys on most browsers. |

| Flow Visualisation | Panel below the card | Animated arrows illustrate money flows (green = premiums, red = protection payments). The colour of the Reference Entity panel flips to red when a credit event stage is reached. |

Show / Hide Details

Select “Show Details” on any card for a deeper narrative: regulatory context, typical documentation, margining rules, etc. The content animates open without re‑loading the page.

Walking Through a Trade

Start at Stage 1 – Trade Initiation. Observe the handshake icon and summary of buyer/seller negotiation.

Click Next or the dot for Documentation to see how the ISDA Master Agreement frames the deal.

Continue through Confirmation → Clearing & Settlement → Ongoing Lifecycle. Notice that the premium‑payment animation is now active.

At Credit Event, the Reference Entity box turns red and the payment arrow direction reverses – simulating the protection payout.

Proceed to Termination to complete the progress bar (100 %). The lifecycle is now reset; you can revisit any step ad‑hoc.

The “CDS Explanation” Tab

This tab is a scrollable reference containing three cards:

What is a CDS? – a plain‑English primer.

Key Components – roles, notional amount, spread, maturity, and credit‑event definitions.

Market Significance – lessons from the 2008 crisis, central‑clearing reforms, and why CDS spreads matter today.

Use this tab first if you are unfamiliar with CDS jargon, then come back to the animated view to cement the concepts.

Background: Credit Default Swaps in Context

A CDS is essentially an insurance contract against default. The buyer pays a periodic spread (quoted in basis points on the notional) to the seller. If the reference entity suffers a contract‑defined credit event (bankruptcy, failure to pay, or restructuring), the seller compensates the buyer – either by accepting delivery of the defaulted bond (physical settlement) or via a cash payment determined in an auction.

CDS contracts gained notoriety during the 2008 financial crisis (e.g., AIG’s writedowns) and are now subject to mandatory central clearing for many standardized trades in the US and EU. Today the market is smaller but remains a key tool for hedging and for extracting a market‑implied measure of credit risk.

Glossary (Quick Reference)

| Term | Meaning |

| ISDA | International Swaps and Derivatives Association; publishes the standard legal framework used here. |

| Notional | Face value on which payments are calculated. |

| Spread / Premium | Quarterly fee (bps per annum) the buyer pays. |

| CCP (Central Counterparty) | Clearing house that novates the trade, becoming the counterparty to both sides. |

| Variation Margin | Daily collateral reflecting mark‑to‑market gains/losses in a cleared CDS. |

| Credit Event | Contract‑defined trigger: Bankruptcy, Failure to Pay, Obligation Acceleration, Obligation Default, Repudiation/Moratorium, or Restructuring. |

Frequently Asked Questions

Q : Can I change the reference entity or notional?

A : The demo is fixed‑parameter for clarity. A future release may expose form inputs for custom scenarios.

Q : Does the tool price a CDS?

A : No, it is an educational life‑cycle simulator. Pricing requires additional market‑data integrations.

Further Reading & Credits

ISDA Credit Derivatives Definitions (latest version)

Hull, J. C. – Options, Futures, and Other Derivatives, Chapter 24 (Global Edition 11e).

Bank for International Settlements – Credit Default Swaps Market Statistics.

Note: This guide is for educational purposes only and does not constitute investment advice.